What’s Included in Our Service.

✓ Rental Income Reporting

We accurately report all rental income, including long-term and short-term rentals, to meet IRS requirements.

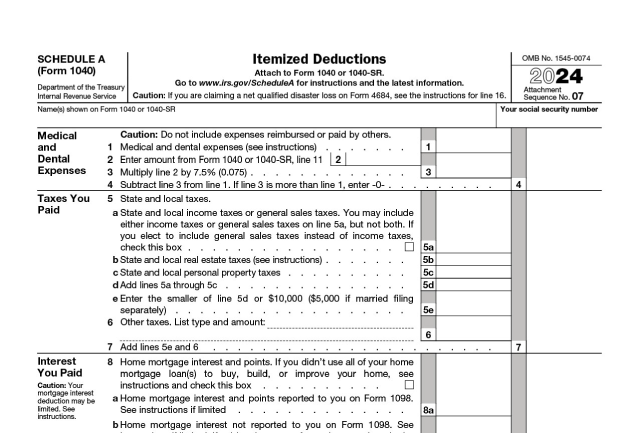

✓ Deduction Maximization

We identify every eligible expense such as mortgage interest, repairs, insurance, property taxes, utilities, management fees, and more.

✓ Depreciation Schedules

We ensure your property is depreciated correctly for maximum long-term tax benefits.

✓ Multi-Property and Multi-State Filings

If you own multiple rentals or properties in different states, we handle all filings seamlessly.

✓ Capital Gains and Losses

We calculate and report gains or losses from the sale of stocks, bonds, real estate, or other assets to minimize taxable income.

✓ Dividend and Interest Income

We correctly report qualified and ordinary dividends, savings account interest, and bond income to ensure compliance.

✓ Cryptocurrency Transactions

We assist with reporting sales, trades, staking income, or digital asset gains under IRS guidelines.

✓ Retirement and Investment Accounts

We handle distributions from IRAs, pensions, annuities, and brokerage accounts, including required minimum distributions.

✓ K-1 Partnership and Trust Income

We manage reporting for pass-through income from partnerships, S corporations, and trusts.